Gain a Competitive Edge With Professional GBP Administration Methods

In the world of global finance, the skilled monitoring of GBP holdings stands as a critical factor that can considerably affect the trajectory of a company or investment profile. As the British pound remains to hold its placement as one of the globe's major money, staying in advance of the curve with experienced tactics is vital for success. From browsing intricate market trends to strategically hedging against prospective risks, the techniques utilized in GBP administration can make all the distinction in obtaining an affordable edge. Remain tuned to find the nuanced techniques and devices that can raise your GBP monitoring video game and set you apart in the dynamic landscape of worldwide finance.

The Significance of GBP Management

Properly taking care of GBP is essential for guaranteeing economic security and long-lasting success in any kind of organization or financial investment endeavor. The management of GBP, or Terrific British Pound, entails carefully keeping an eye on currency exchange rate, market trends, and economic indications that can influence the value of the currency. By remaining educated and aggressive in GBP management, companies can alleviate threats connected with currency changes and enhance their monetary efficiency.

One vital reason why GBP management is vital is the influence it carries international trade. For companies taken part in importing or exporting products and solutions, variations in the GBP exchange rate can directly impact the price of deals and profitability. By effectively managing GBP exposure via hedging approaches or other danger monitoring techniques, organizations can safeguard their profits and continue to be competitive in the worldwide market.

Furthermore, GBP management plays an important function in financial investment profiles. Capitalists holding assets denominated in GBP are exposed to currency risk, which can wear down returns if not appropriately handled. By proactively checking and changing GBP settings based upon market problems, financiers can enhance portfolio diversity and overall performance. To conclude, the importance of GBP administration can not be overemphasized, as it is a vital variable in keeping economic wellness and attaining lasting development in today's dynamic company environment.

Analyzing Market Trends and Data

Provided the intrinsic volatility of the GBP exchange price and its direct impact on investors and businesses, a vital element to think about is the careful analysis of market trends and data. Utilizing advanced logical tools and remaining updated on market data can give valuable insights right into potential future movements of the GBP, aiding in risk reduction approaches. Recognizing the partnership between market fads and the GBP exchange price can help investors and companies expect market changes and adjust their approaches appropriately.

Executing Hedging Methods

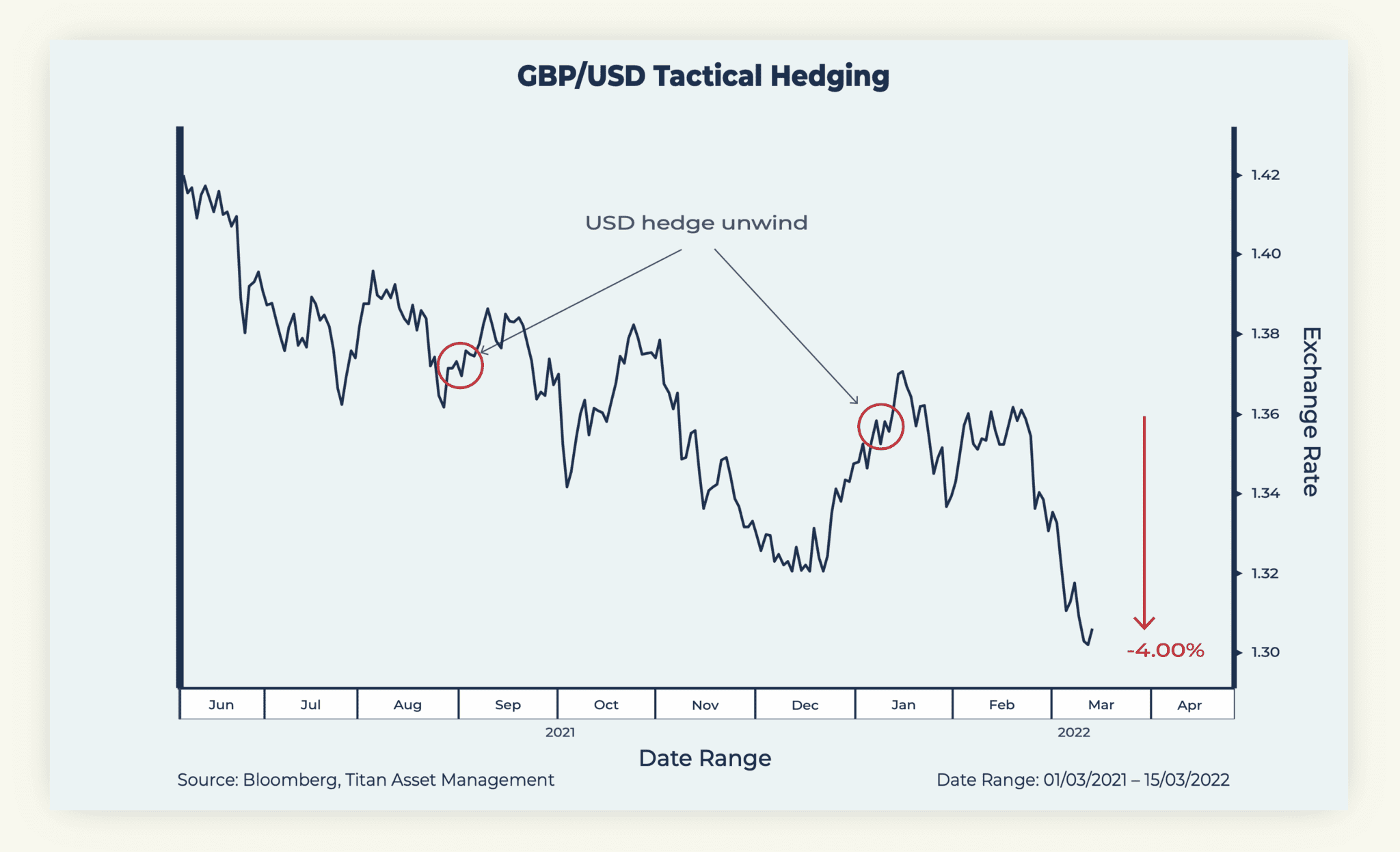

Establishing a detailed hedging technique is vital for financiers and businesses aiming to navigate the uncertainties of the GBP exchange price efficiently. Hedging strategies include using economic instruments or strategies to balance out possible losses from negative price motions. For GBP management managing GBP-related risks, companies can make use of different hedging devices such as forward agreements, options, or currency swaps.

Ahead contracts permit entities to secure in a currency exchange rate for a future deal, safeguarding them from negative money motions. If the market moves favorably, alternatives supply the flexibility to either continue with the exchange at a predetermined rate or opt-out - google business profile management. Money swaps entail trading cash flows in different currencies to reduce exchange price danger

When executing hedging strategies, it is vital to analyze the cost-benefit evaluation, taking into consideration factors like transaction costs, hedging instrument liquidity, and the degree of defense required. Regular monitoring and modifications to the hedging approach are additionally vital to make sure positioning with altering market conditions and company goals. By using efficient hedging financiers, techniques and companies can much better handle GBP currency exchange rate changes and gain an one-upmanship in the market.

Leveraging Forex Tools and Platforms

Making use of innovative foreign exchange tools and platforms is essential for optimizing GBP administration methods in today's dynamic market environment. Using advanced technical options can give investors and companies with an affordable side by supplying real-time data evaluation, progressed charting abilities, and automated trading capabilities. GBP management. Systems such as MetaTrader 4 and 5, cTrader, and TradingView offer a large range of tools that can help in keeping track of market trends, performing trades, and handling danger effectively

Foreign exchange devices like economic calendars, volatility indications, and connection matrices allow market individuals to stay notified about key financial occasions, examine market belief, and identify prospective possibilities for revenue. In addition, algorithmic trading systems and expert consultants can assist improve trading processes and make certain prompt execution based on established standards.

Keeping Track Of Political and Financial Events

Conclusion

To conclude, efficient GBP monitoring is crucial for acquiring an one-upmanship in the market. By evaluating market patterns, carrying out hedging approaches, leveraging forex devices and platforms, and checking financial and political events, organizations can make educated choices to safeguard versus currency variations and make best use of earnings. It is essential for organizations to stay proactive and strategic in their strategy to GBP administration to remain ahead of the competitors.

Comprehending the connection in between market fads and the GBP exchange price can assist investors and businesses anticipate market changes and readjust their approaches as necessary.In the world of GBP monitoring methods, staying abreast of economic and political events is critical for making informed decisions in the ever-changing market landscape. Comprehending how these occasions influence the currency markets can assist GBP supervisors prepare for market activities and adjust their strategies appropriately.